Estrategias Profesionales de Trading

Domina técnicas de trading probadas y mejora tu tasa de éxito

Core Trading Principles

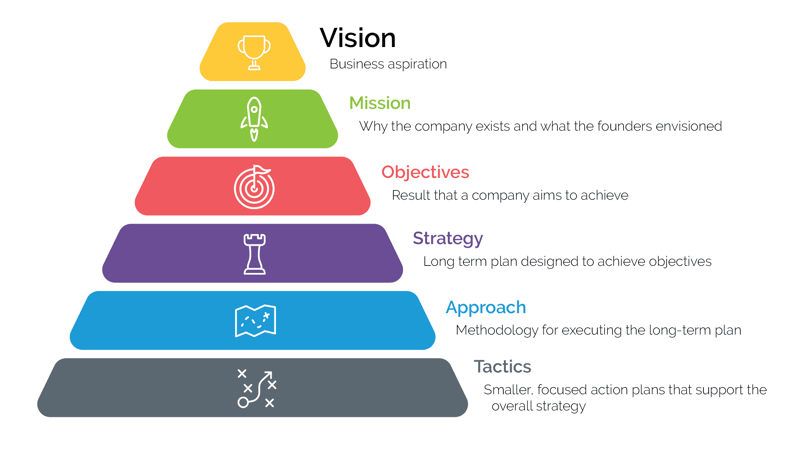

Clear Strategy

Define your trading plan before entering any position

Market Awareness

Stay informed about market conditions and news

Patience & Discipline

Wait for the right opportunities and stick to your plan

Risk Management

Never risk more than 1-2% of your capital per trade

Professional Trading Strategies

Proven strategies used by professional traders to achieve consistent results in various market conditions.

Trend Following Strategy

Learn to identify and follow market trends for consistent profits.

Key Points:

- Identify strong market trends

- Use moving averages for confirmation

- Set appropriate stop-losses

- Ride trends until reversal signals

Technical Analysis Mastery

Master chart patterns, indicators, and technical signals.

Key Points:

- Learn key chart patterns

- Combine multiple indicators

- Understand market psychology

- Perfect entry and exit timing

Fundamental Analysis Guide

Analyze economic factors that drive market movements.

Key Points:

- Economic calendar analysis

- Company financial health

- Market sentiment assessment

- News impact evaluation

Advanced Risk Management

Protect your capital with sophisticated risk control techniques.

Key Points:

- Position sizing formulas

- Portfolio heat monitoring

- Correlation analysis

- Drawdown management

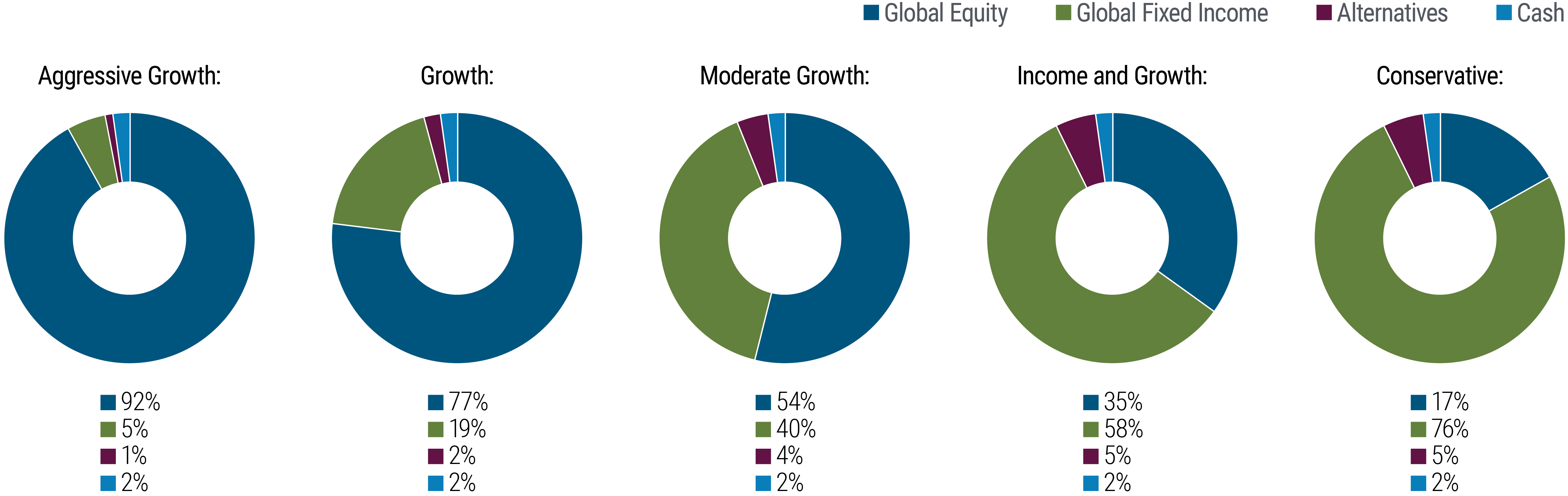

Portfolio Diversification

Build resilient portfolios across multiple asset classes.

Key Points:

- Asset allocation principles

- Correlation understanding

- Rebalancing strategies

- Risk-adjusted returns

Scalping & Day Trading

Quick profit strategies for active traders.

Key Points:

- High-frequency setups

- Tight risk management

- Market timing precision

- Emotional discipline

Strategy Implementation & Backtesting

Learn how to properly implement strategies, backtest them on historical data, and optimize for better performance. Our platform provides all the tools you need for strategy development and testing.

Historical Data Analysis

Test strategies on years of market data

Performance Metrics

Detailed analytics and performance reports

Risk Assessment

Comprehensive risk analysis and optimization

Start Implementing Winning Strategies

Test these proven strategies risk-free with our demo account before applying them with real money.